Planning your next vacation can be both exciting and overwhelming. Most travelers do their research and make reservations for flights, activities, and accommodations online. In particular, hotel websites offer the convenience of browsing, comparing, and booking hotels from anywhere. Hotel bookings and revenue have recovered from the depths of the pandemic.

Planning your next vacation can be both exciting and overwhelming. Most travelers do their research and make reservations for flights, activities, and accommodations online. In particular, hotel websites offer the convenience of browsing, comparing, and booking hotels from anywhere. Hotel bookings and revenue have recovered from the depths of the pandemic.

Yet with all this information at hand, finding the right hotel can feel like a daunting task.

One early pain point travelers encounter is sifting through numerous hotel listings, which can leave them overwhelmed and discouraged. To help travelers zero in on the right accommodation, hotel websites offer many search features so users can easily consider the best locations, amenities, customer ratings, and prices that fit their needs.

If travelers can’t easily wade through the options to find the best hotel, or can’t make a reservation easily, they might book a different hotel or check out hotel aggregator websites such as Expedia or Travelocity.

To better understand the hotel researching and booking experience, we collected data using our MUiQ platform on a variety of attitudes and intentions toward five popular hotel websites:

- Best Western

- Hilton

- Holiday Inn

- Hyatt

- Marriott

We computed SUPR-Q® and Net Promoter scores, investigated reasons for using the websites, measured users’ attitudes regarding their experiences, conducted key driver analyses, and analyzed reported usability problems.

Benchmark Study Details

In May of 2023, we asked 254 users of hotel websites in the US to recall their most recent experience and perceptions of one of the hotel websites on their desktop and mobile app (if applicable) in the past year. Participants then completed one task on the same website in which they were asked to find a hotel within certain parameters.

Participants completed the eight-item SUPR-Q (which includes the Net Promoter Score) and the two-item UX-Lite® standardized questionnaires, and they answered questions about their brand attitudes, usage, and prior experiences after both study components.

Quality of the Hotel Website UX: SUPR-Q

The SUPR-Q is a standardized questionnaire widely used for measuring attitudes toward the quality of a website user experience. Its norms are computed from a rolling database of around 200 websites across dozens of industries.

SUPR-Q scores are percentile ranks that tell you how a website’s experience ranks relative to the other websites (50th percentile is average). The SUPR-Q provides an overall score as well as detailed scores for subdimensions of Usability, Trust, Appearance, and Loyalty.

The hotel websites in this study collectively performed well and averaged in the 73rd percentile. Hyatt received the highest SUPR-Q score at the 84th percentile, closely followed by Hilton (83rd percentile), while Marriott received the lowest overall score in the 57th percentile.

Usability Scores and Appearance

We asked participants to rate how easy they thought it was to use and navigate the websites. All websites scored well above the 50th percentile in usability, except for Marriott, which fell in the 45th percentile. Hyatt had the highest usability score (93rd percentile), followed by Holiday Inn (91st percentile).

Participants on Marriott reported issues with the website related to slow loading and difficulty configuring filtering and sorting options. Comments regarding usability for Marriott included:

- “It’s extremely frustrating, the distance filter does not work at all, it’s useless. You should be able to sort results by distance and ratings, among other things.” — Marriott

- “The search was challenging and would make it hard to find a good room in the future.” — Marriott

- It is very slow, cluttered and has a lot of bugs.” — Marriott

We also asked participants to rate the appearance of the hotel websites. Appearance scores were very high for the Hyatt and Hilton websites (90%) but were lower for the other three sites. Best Western had the lowest appearance score, a below-average 46%. Participants on Best Western and Marriott had issues with cluttered web pages, and they reported feeling overwhelmed by the information on the website.

- “The way they have the rates listed is a bit odd, as well as how bulky and cluttered it felt for being a simple design.” — Best Western

- “It is very crowded. [There’s] too much info on each page.” — Best Western

- “It feels so cluttered. I’m ADHD, so this website was not user-friendly for me. There was too much to look at… There is just way too much going on for the home page to be user-friendly and ‘simple.’ I felt very overwhelmed.” — Marriott

- “I find it way to busy and cluttered looking. I prefer to book on Expedia because it’s streamlined and clean and easy to look at and navigate.” — Marriott

Loyalty/Net Promoter Scores

The average NPS for the hotel websites was 7% (more promoters than detractors). Similar to SUPR-Q scores, Hyatt had the highest NPS (21%), closely followed by Hilton (17%). Marriott and Holiday Inn both scored −4%, which were the lowest scores in the group. In general, a better user experience is a good predictor of customer loyalty.

Website and Mobile App Usage

As a part of this benchmark, we asked participants how they accessed the hotel websites. All participants reported using their desktop/laptop computers (this was a requirement for participation in the survey), with 73% also using mobile websites and 46% also using mobile apps.

Opposite of desktop NPS scores, participants were most likely to recommend the Marriott mobile app (24%) and least likely to recommend the Hyatt mobile app (−14%).

Users reported visiting the hotel websites and apps a few times per year or less.

Key Drivers of the Hotel Website Experience

To better understand what affects SUPR-Q scores and Likelihood-to-Recommend (LTR) ratings, we asked respondents to rate 12 attributes of the hotel website experience (full details are in the downloadable report).

We conducted key driver analyses (regression modeling) to quantify the extent to which ratings on these items drive (account for) variation in overall SUPR-Q scores and, separately, LTR (the rating from which the NPS is derived).

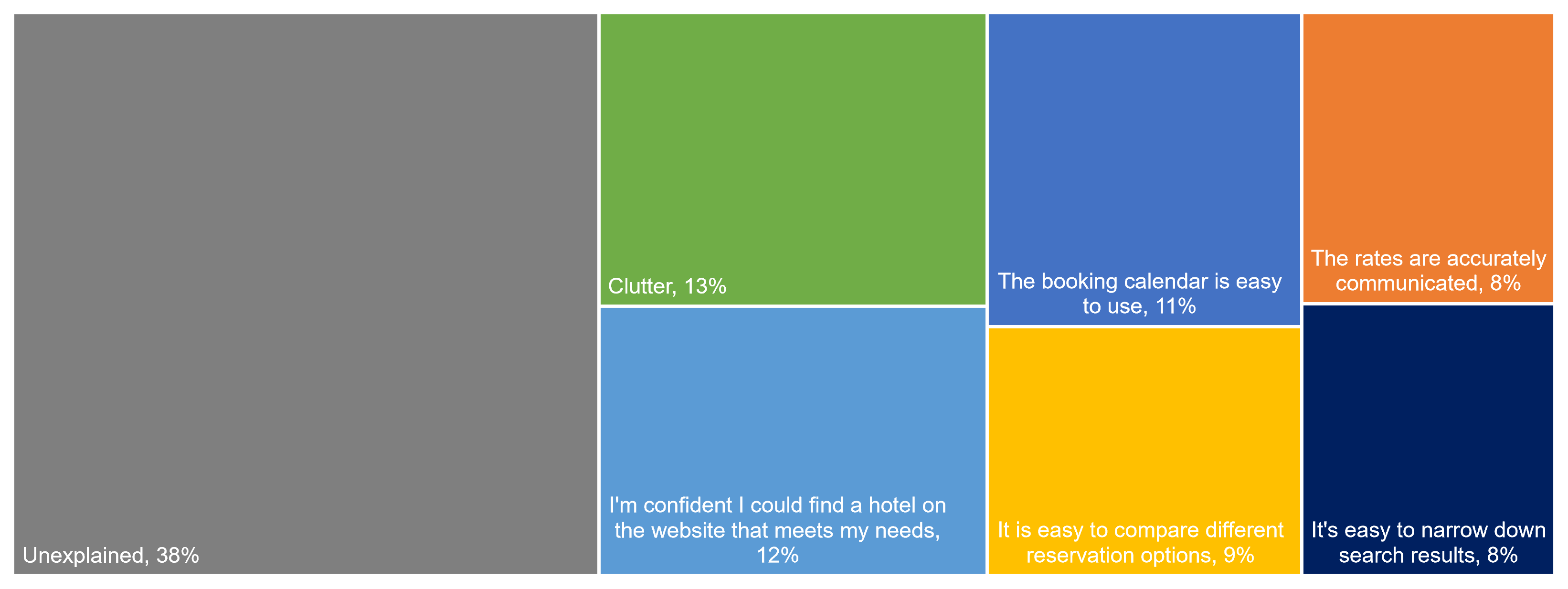

SUPR-Q Drivers. As shown in Figure 1, the top key driver of the overall website experience was “Clutter,” accounting for 13% of the variability in SUPR-Q scores. This was followed by “I’m confident I could find a hotel on the website that meets my needs” (12%) and “The booking calendar is easy to use” (11%). Taken together, six significant predictors accounted for 61% of the variance in the SUPR-Q scores.

What to Improve: Key Drivers

Other key drivers our respondents highlighted as common problems and frustrations across the hotel websites included clunky interactions with the booking calendar, difficulty narrowing down search results, and cluttered web pages.

Booking calendar interactions were clunky

The ease of interacting with the booking calendar was found to be a key driver of the hotel SUPR-Q scores, and it was also identified as a frequent problem across the websites. Participants mentioned problems interacting with the booking calendar on two of the five hotel sites we tested, and it was the top complaint for the Hilton website, where 15% of participants reported it as an issue.

The Hilton booking calendar did not have a way to confirm the selected dates; users needed to “x” out of the booking calendar once they selected their desired dates. Participants expected to set or confirm their selections, instead of simply closing out the calendar. Other hotel websites automatically closed the calendar after the checkout date was selected, or they used a Done or Apply button. Video 1 shows how one user had problems with the calendar on the Hilton website.

Video 1: Users must “x” out of the booking calendar on the Hilton website, which is not intuitive. Users expected to set or confirm their selected dates.

- “When selecting the dates for booking there’s no confirmation that the website got them you have to exit out the calendar and it’s updated but it’s confusing at first.” — Hilton

- “It was unclear that you had to ‘X’ out of a box once you selected dates.” — Hilton

Holiday Inn users also had difficulty using the booking calendar in some cases. In Video 2, the participant tried to type the dates manually, which was cumbersome.

Video 2: A participant struggling to type the dates into the booking calendar. Video captured in our MUiQ Platform.

- “I found that the calendar was a little clunky to use when choosing the booking dates.” — Holiday Inn

- “The calendar felt a little weird to use. The ‘Book Now’ button did not make me think I would be redirected to a list of different bookings.” — Holiday Inn

Interacting with the booking calendar is likely one of the first things users will do on a hotel website, so if this interaction is poor, it can leave users feeling frustrated from the get-go.

Search results were difficult to narrow down

The ease of narrowing down search results was found to be a significant key driver of the hotel website experience, as well as the NPS, and participants on all five websites also mentioned some difficulty with the sorting and filtering options.

While all the hotel websites had numerous sorting and filtering options, participants still had some trouble configuring the settings to fit their needs. For example, in the task, participants were asked to look for a hotel that was a specific distance from Orlando that had at least a four-star rating. Based on these parameters, it would have been helpful if users could filter by a specific rating and sort by distance, but they were unable to do this.

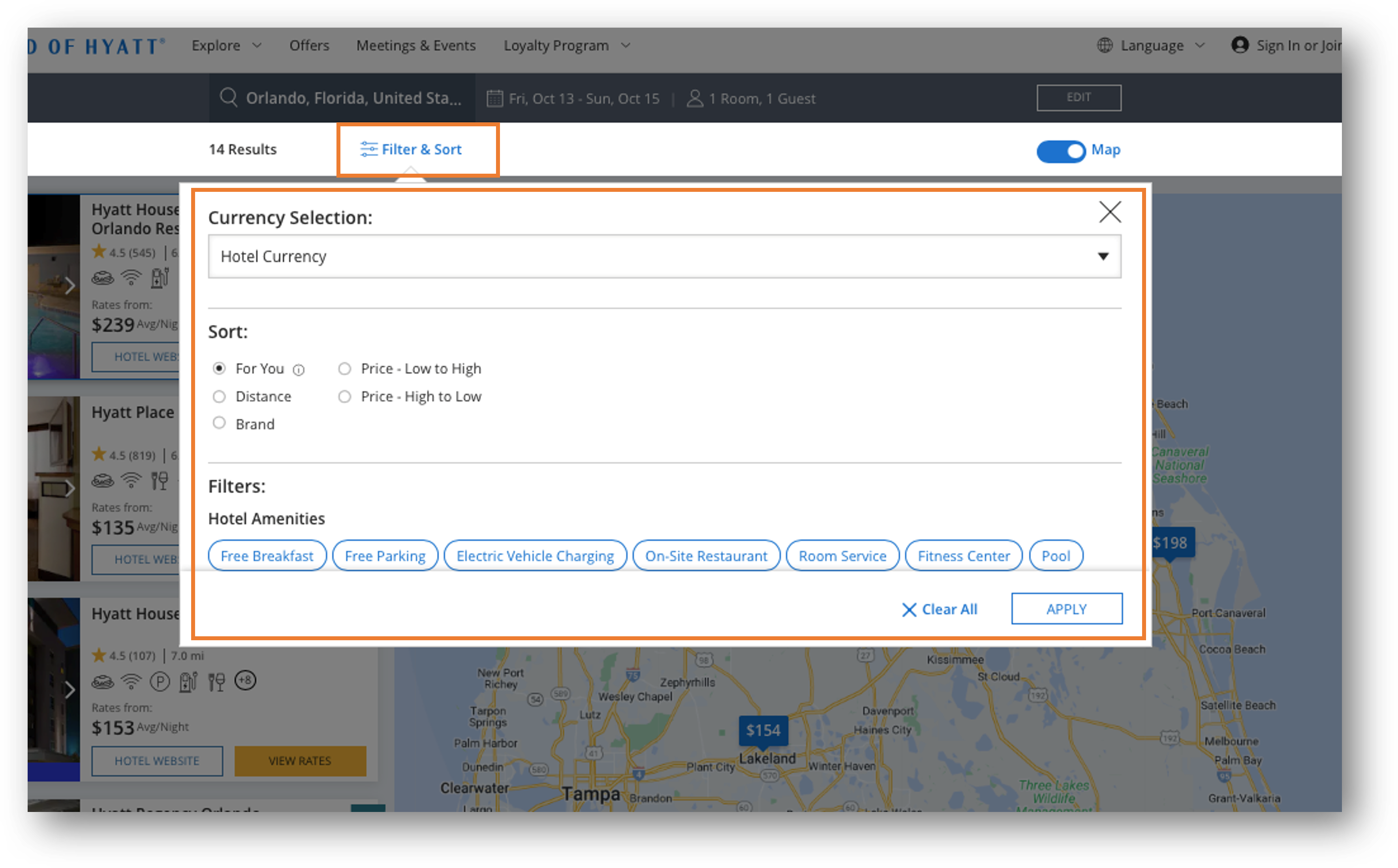

The Hyatt website did not have any way to sort or filter by customer rating (see Figure 2), which was frustrating to participants considering the parameters of the task.

- “I wish there was an ability to add more filters to sort by not just a singular one. Also, for this task it would have been useful to sort by rating which I don’t think was an option at all.” — Hyatt

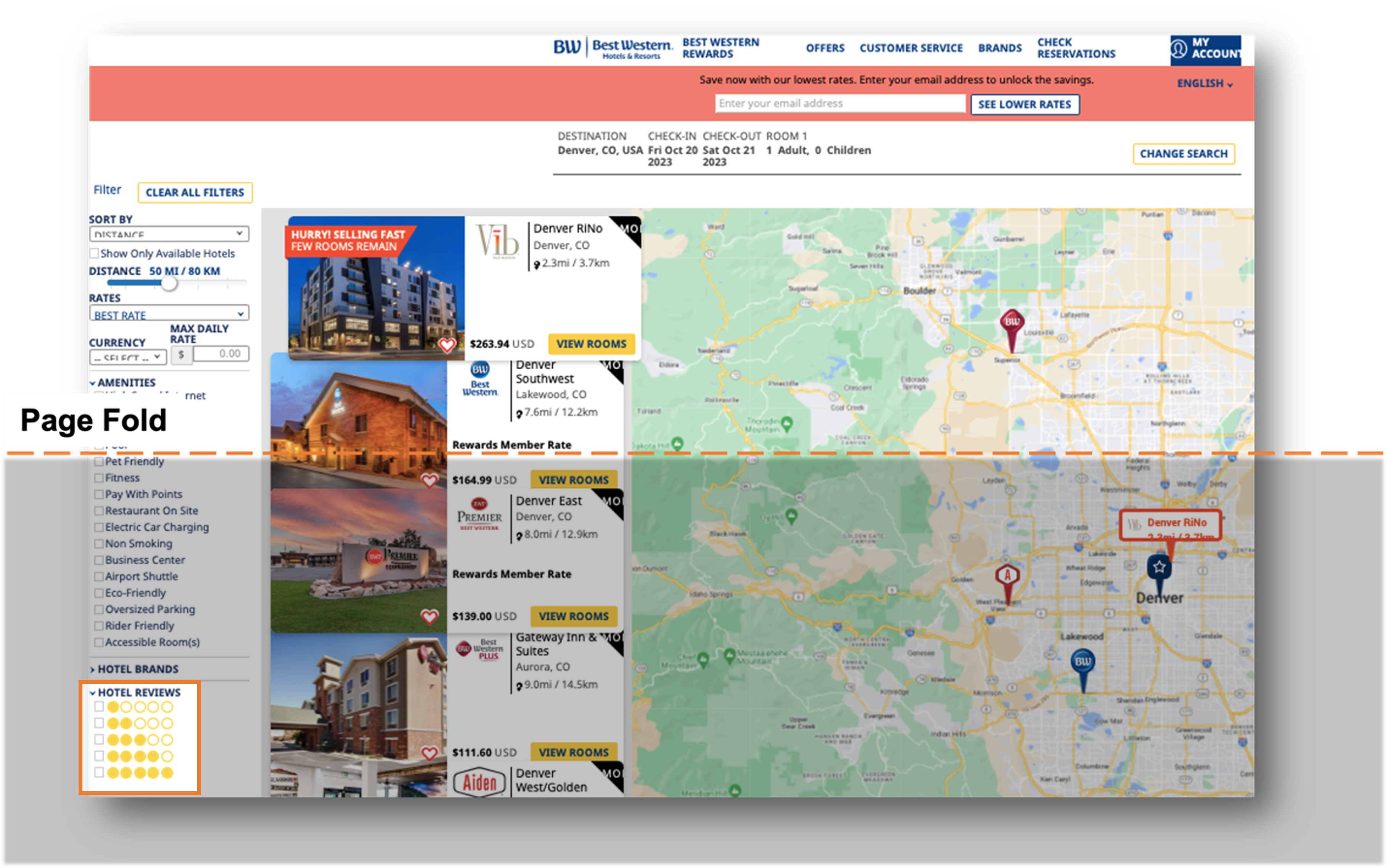

On the Best Western and Hilton sites, some filters were hidden in scrolling side menus or easily overlooked. Around 8% of users on the Hilton website also said the number of search results was overwhelming, so having good sorting and filtering options helps to sift through numerous hotels. On Best Western, users had to scroll down to see the filters, as shown in Figure 3.

- “I couldn’t find an option to filter the hotels by its distance. It might already filter them by the closest hotels towards the top. But I would like there to be a feature to filter distances.” — Hilton, participant did not notice the distance filter

- “I wish I could filter hotels by their ratings.” — Best Western, participant did not see all filter options

Being able to easily configure sorting and filtering options is especially important for hotel websites due to all the different requirements travelers have for their accommodations, such as amenities, location, and star rating.

Cluttered web pages

Clutter was mentioned as a problem for all five hotel websites, and it was the most common frustration for Holiday Inn. As many as 13% of Holiday Inn participants and 15% of Best Western participants thought the websites felt cluttered and overwhelming. (Figure 4 shows how cluttered the Holiday Inn search results were.)

- “Everything seemed very cluttered. It was somewhat annoying to navigate the homepage because of how cluttered and close together everything was.” — Holiday Inn

- “I was just a little put off by how much there was on the site. I understand most of the information is really important and there’s a wealth of information to be viewed, but there was just a lot to look at and scroll through.” — Holiday Inn

- “It is very crowded. Too much info on each page.” — Best Western

Of the hotel websites, Hilton had the fewest comments about clutter (4%).

Summary and Takeaways

An analysis of the user experience of five hotel websites found:

- Hotel websites have an above-average user experience. The hotel websites in this study collectively performed well and averaged in the 73rd percentile. Hyatt received the highest SUPR-Q score at the 84th percentile, closely followed by Hilton (83%), while Marriott scored the lowest at the 57th percentile.

- Clunky booking calendar interactions are a poor way to start the experience. Interacting with the booking calendar was a cumbersome experience for some users on the hotel websites. It was also found to be a significant key driver of the overall website experience and was a top issue for the Hilton website. Using the booking calendar is likely one of the first things users do on the hotel websites, so it ought to be a smooth interaction.

- Narrowing down to the right hotel can be difficult. The ease of narrowing down search results was found to be a significant key driver of the hotel website experience, as well as the NPS, and participants on all five websites mentioned some difficulty with the sorting and filtering options. Users unable to configure filters to match their requirements led to a frustrating experience.

- Cluttered websites burden the experience. Clutter was an issue mentioned by participants on all five of the hotel websites, but it was a top issue for Holiday Inn and Best Western. Cluttered web pages and overwhelming information frustrated users as they navigated through the hotel websites.

For more details, see the downloadable report.