When people need office supplies, they’re unlikely to use Dunder Mifflin; instead, they’ll search online.

When people need office supplies, they’re unlikely to use Dunder Mifflin; instead, they’ll search online.

But like the fictional paper supply company, many well-known office-supply brands (some with physical stores) have struggled to compete with Amazon and haven’t recovered from the impacts of COVID policies on in-person work. In 2019, Office Depot closed 50 stores, then from 2020 through 2021 they closed 263 more, and they have more closures planned in 2023.

To understand the online office supply purchasing experience, we collected data on a variety of attitudes and intentions toward four websites that sell a variety of office supplies:

- Office Depot

- Office Supply

- Quill

- Staples

We used our MUiQ platform to collect SUPR-Q® and and Net Promoter scores, investigated reasons for using the websites, measured users’ attitudes regarding their experiences, conducted key driver analyses, and analyzed reported usability problems.

Benchmark Study Details

In February of 2023, we asked 203 recent users of office supply websites in the US to recall their most recent experiences and perceptions of one of the listed office supply sites on their desktop and mobile app (if applicable) in the past year.

Participants completed the eight-item SUPR-Q (which includes the Net Promoter Score) and the two-item UX-Lite® standardized questionnaires, and they answered questions about their brand attitudes, usage, and prior experiences.

Quality of the Office Supply Website UX: SUPR-Q

The SUPR-Q is a standardized questionnaire widely used for measuring attitudes toward the quality of a website user experience. Its norms are computed from a rolling database of around 200 websites across dozens of industries.

SUPR-Q scores are percentile ranks that tell you how a website’s experience ranks relative to the other websites (the 50th percentile is average). The SUPR-Q provides an overall score, as well as detailed scores for subdimensions of Usability, Trust, Appearance, and Loyalty.

The office supply websites in this study collectively averaged at the 70th percentile. Office Supply received the highest SUPR-Q score at the 83rd percentile, and Office Depot scored the lowest at the 50th percentile.

Usability Scores and Trust

We asked participants to rate how easy they thought it was to use and navigate the websites. All websites scored at or above the 50th percentile in usability. Office Supply had the highest usability score (94th percentile), and Office Depot had the lowest (50th percentile). Comments regarding usability for some of the brands included

- Office Depot: “I have found the site to be slow and have run into errors. For example, when sorting by “Price Low to High” the first page of results showed every product as $0 the last time I used the site.”

- Office Supply: “They have an easy website to navigate and always have what I need in terms of office supplies needed in stock. It’s very easy from the process of picking out the items all the way to checkout.”

- Quill: “I like that everything is accessible and in the open. You do not have to go searching for most things as it’s all laid out in the open. I like how the tracking order option is on the first page at the very top, easily accessible.”

- Staples: “Some of the filters don’t have all of the specifications that you might want to filter down the product listings.”

We also asked participants to rate the trust and credibility of the office supply websites. Trust scores were higher than usability scores. Quill had the highest trust score (95%), closely followed by Staples (93%)—note that Staples is the parent company of both brands. Office Depot and Office Supply had similar trust scores at 78% and 73% respectively.

Loyalty/Net Promoter Scores

The average NPS for the office supply websites was 10% (more promoters than detractors), ranging from −6% for Office Depot to 23% for Quill. In general, a better user experience is a good predictor of customer loyalty. Comments about the office supply websites related to NPS ratings included:

- Office Depot: “The Office Depot website is comprehensive, but I find it cluttered and crowded, and I’ve run into difficulties navigating to find specific items I’m looking for.”

- Office Supply: “Officesupply.com has a minimalist interface that is easy to locate important features. I do not feel overloaded with too much information or pop-ups which contributes to the ease of navigation and digestion of information. I feel the website is reputable and trustworthy overall and feel comfortable making online purchases through the website.”

- Quill: “The Quill prices are very low, and they have good sales. The website is very user friendly and loads very fast. The site is very straightforward and easy to use.”

- Staples: “Staples is a good site, but I feel like it could be simpler. The set-up is a bit cluttered, especially on the front page, which can deter some people. Also, I feel like with things most people would buy from Staples would be best bought offline considering the shipping price.”

More verbatim comments are available in the downloadable report.

Websites and Mobile App Usage

As a part of this benchmark, we asked participants how they accessed the office supply websites. All participants reported using their desktop/laptop computers (this was a requirement for participation in the survey), with 65% also using mobile websites and 30% also using mobile apps.

The typical frequency of use was a few times a year for desktop websites (on average, fewer than 1% reported daily use on desktop). Office Supply was the most visited mobile website, with 6% going there a few times a month.

Key Drivers of the Office Supply Website Experience

To better understand what affects SUPR-Q scores and Likelihood-to-Recommend (LTR) ratings, we asked respondents to rate 15 attributes of the office supply website experience (full details are in the report).

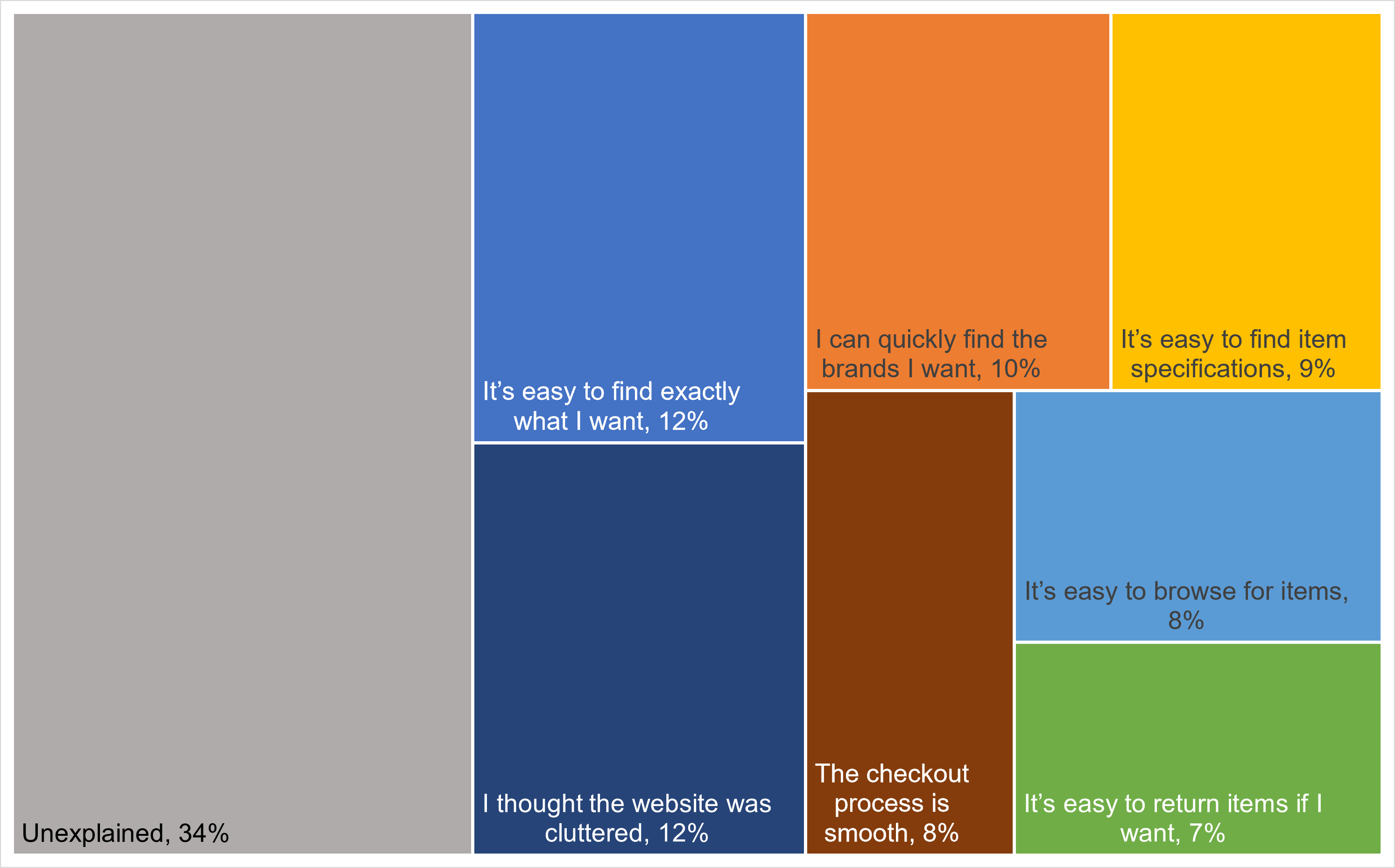

We conducted key driver analyses (regression modeling) to quantify the extent to which ratings on these items drive (account for) variation in overall SUPR-Q scores and, separately, LTR (the rating from which the NPS is derived).

SUPR-Q Drivers. As shown in Figure 1, the top key drivers were the ease of finding products and website clutter, each of which accounted for 12% of the variability in SUPR-Q scores. Taken together, seven significant variables explain 66% of the variance in the SUPR-Q scores.

Best and Worst Ratings

We identified the best and worst performers by looking at various top-box response rates for the key driver items.

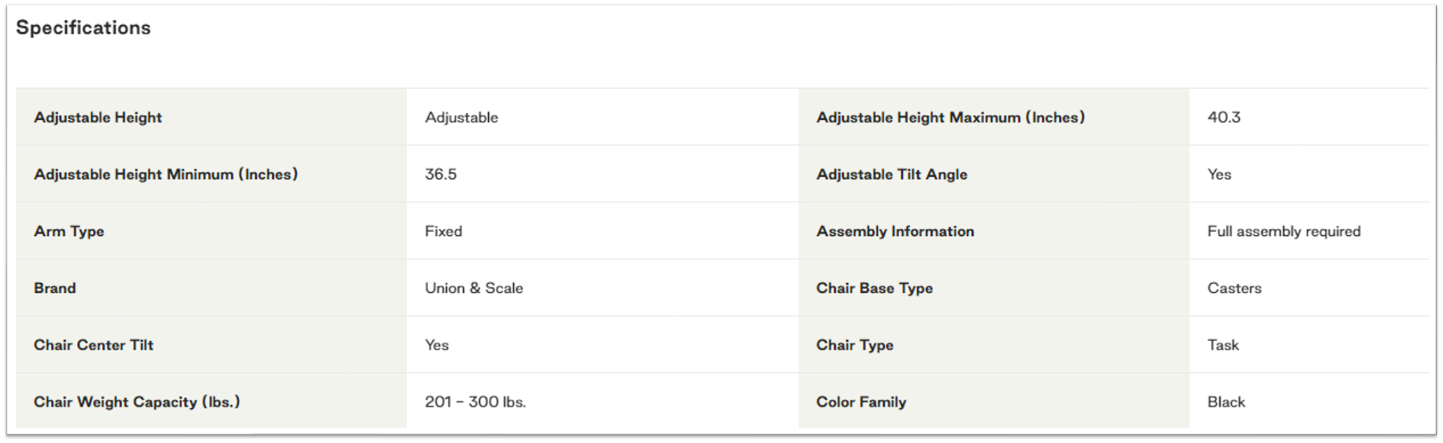

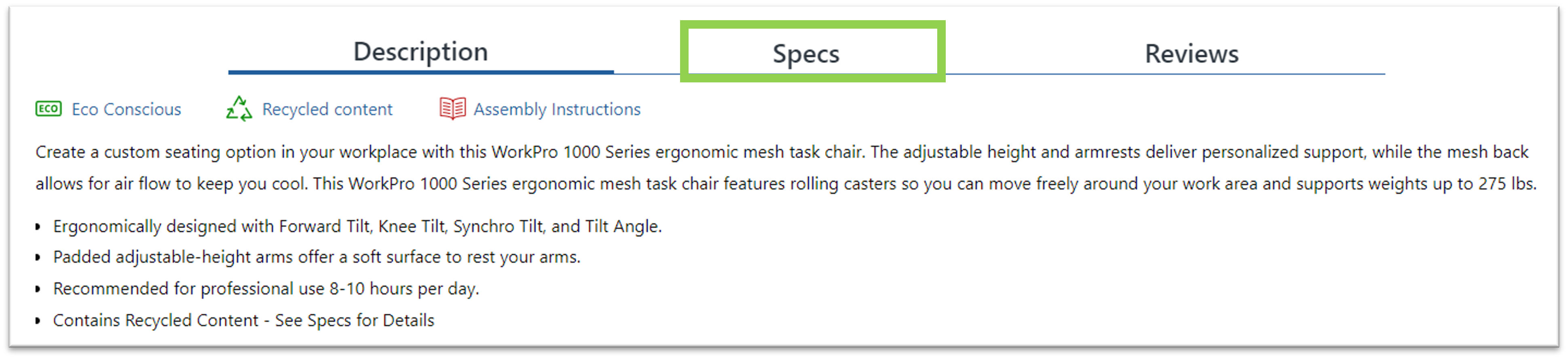

Item Specifications

Ease of finding item specifications was a significant key driver for the office supply website experience, accounting for 9% of the variation in SUPR-Q scores.

Quill had the highest top-box score for this website attribute, with 55% of respondents strongly agreeing that it was easy to find item specifications. Office Depot had the lowest score at 42% (see Figure 2). The group average was 48%.

“They have a great selection. I can find exactly what I want with a bit of searching, and I have no problem looking at alternatives for those items. If I’m looking for a specific size of something, I can usually find it.” — Quill

“[Item specifications are] difficult to find. Perhaps they can change how to narrow down the exact ink cartridge that I’m looking for. Go from company, to model, and so on.” — Office Depot

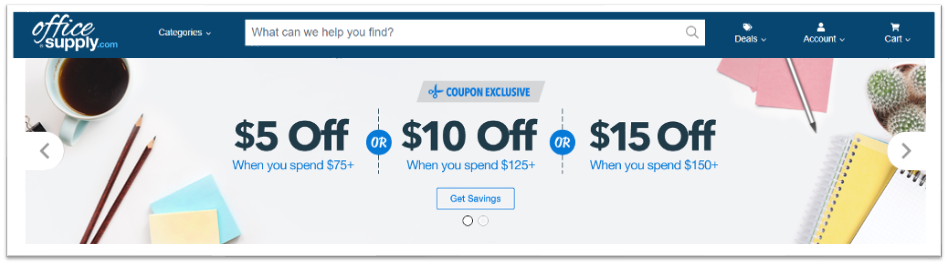

Discounts and Deals

Finding discounts and deals easily was not a key driver for the office supply website’s experience. However, two out of four of the office supply websites (Quill and Staples) had high prices as a top issue among respondents.

When rating the ability to find discounts and deals, Office Supply had the highest top-box score, with 53% of respondents strongly agreeing. Only 34% of respondents strongly agreed that it was easy to find deals with Staples (see Figure 3). The group average is 42%.

“I’ve noticed that some of the prices are a bit higher than I could find on other places.” — Quill

“Sometimes the prices are a bit high compared to other stores, so I would rather spend more time searching to get a better deal.” — Staples

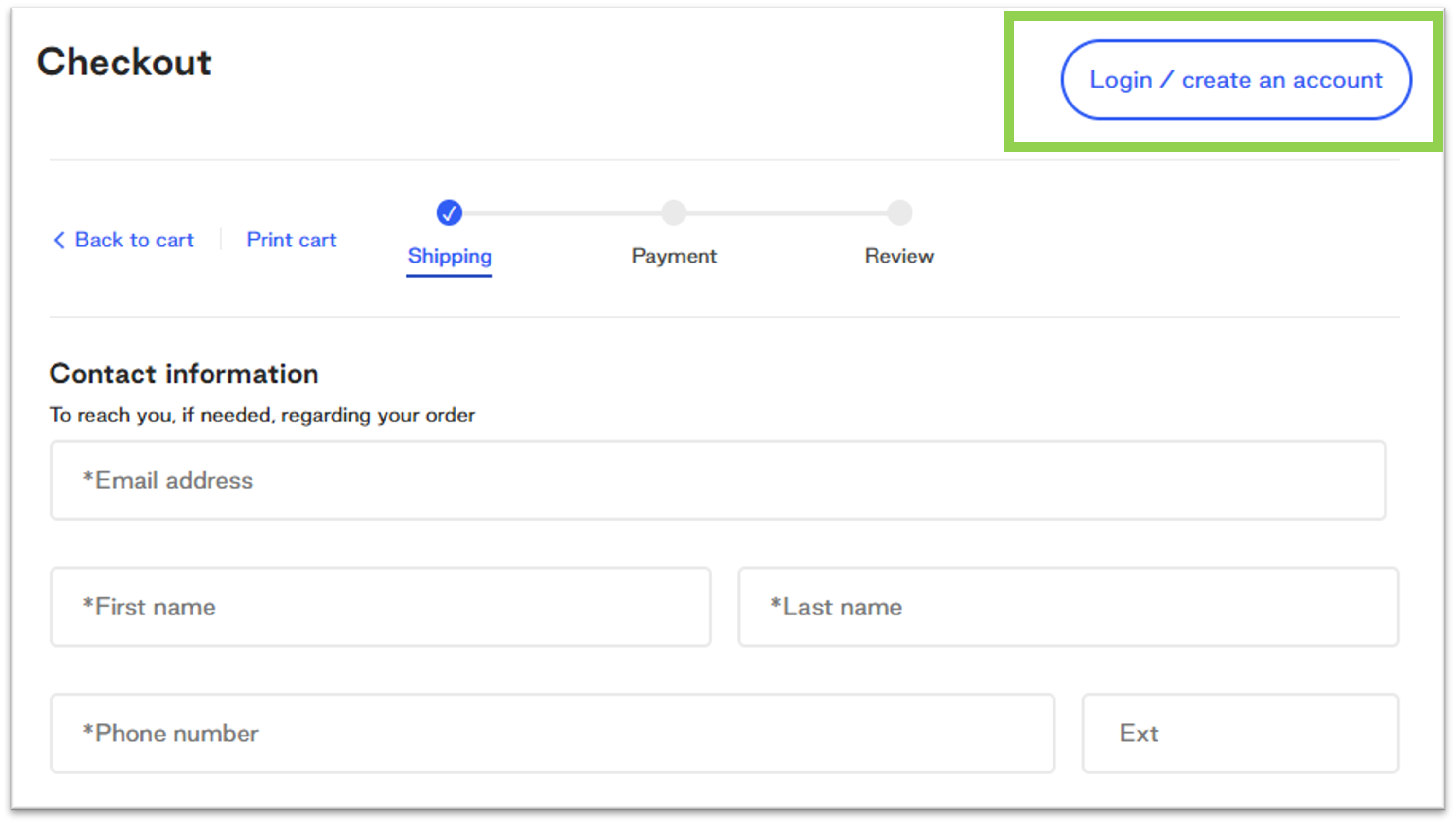

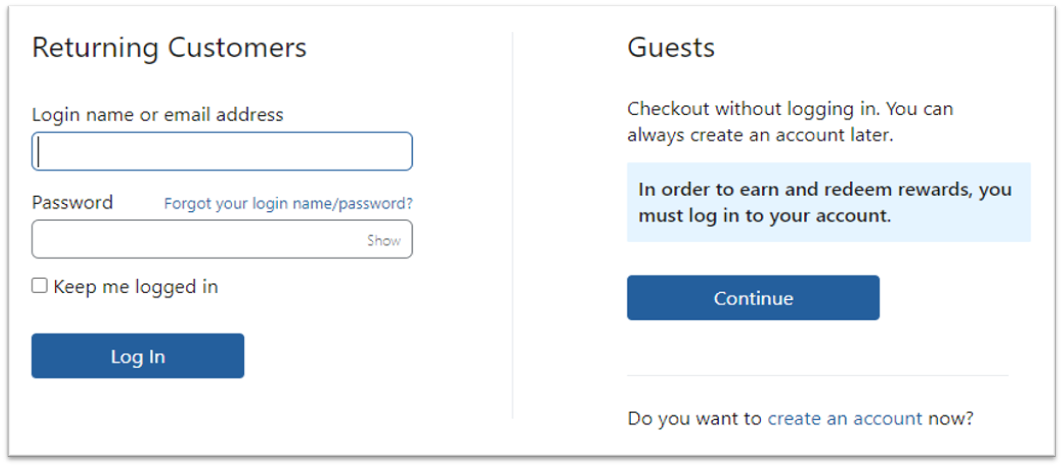

Checkout Process

A smooth checkout process was a significant key driver for the office supply website experience, accounting for 8% of the variation in SUPR-Q scores.

Quill had the highest top box score, with 53% of respondents strongly agreeing that the checkout process was smooth, while Office Depot had the lowest score at 46% (see Figure 4).

“Checkout is easy. I can always easily find my previous orders.” — Quill

“It does feel a little cluttered. Checkout works fine, but there’s too much on the page right away.” — Office Depot

What to Improve

Participants had a few common problems and frustrations across most of the office supply websites, such as cluttered web pages and items being out of stock or unavailable.

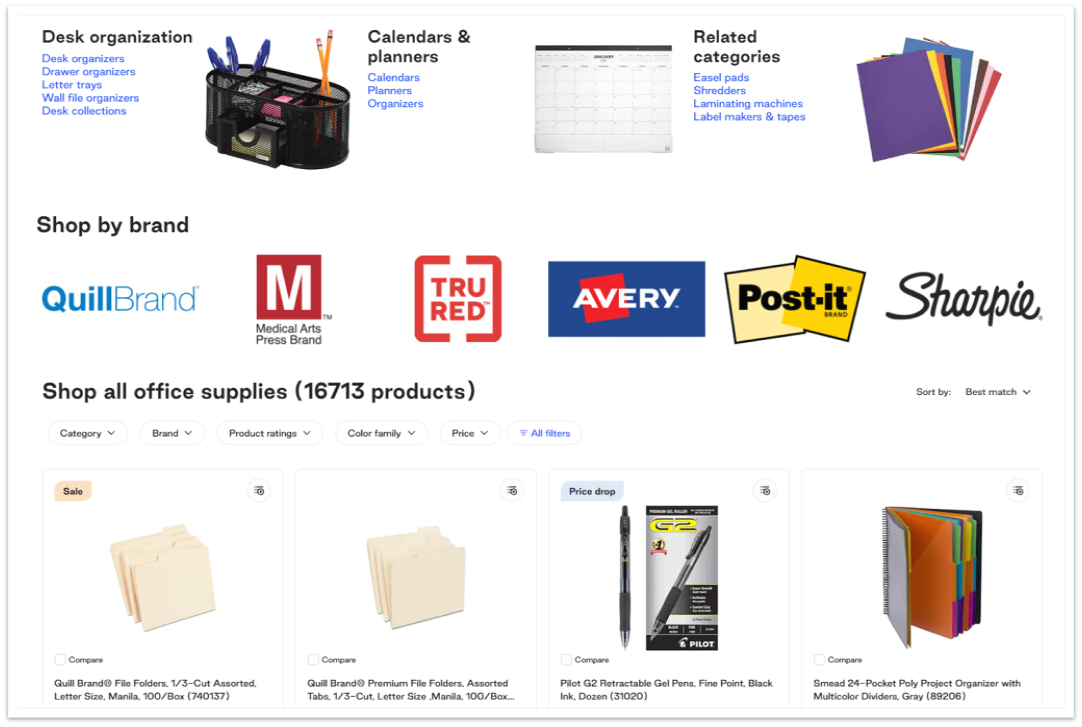

Cluttered Webpages

Across all websites, users experienced issues with cluttered websites (see Figure 5). Clutter leads to other frustrations, such as difficulty with navigation and frustration with pop-ups.

“It’s kind of cluttered with recommendations, ads, and other things when I am just looking for a specific type of product.” — Office Depot

“Sometimes I get lost with so many items on the screen.” — Office Supply

“It is a bit cluttered. At times I feel like there is so much going on that I can’t focus. I have to really focus and just click my search terms asap or I’ll get overwhelmed.” — Quill

“Too cluttered. Too many pictures and sliding offers at the top of the page. Not easy to quickly find brands you want.” — Staples

Items Out of Stock or Unavailable

Users frequently complain that items are out-of-stock, have limited quantities, or are unavailable for unknown reasons (see Figure 6). This complaint can also manifest when users check inventory availability for their nearest physical store and then arrive at the store to find the item unavailable.

“Some departments seem to have a limited amount of different products.” — Office Depot

“One issue I have had with the website is when something is not in stock, and they don’t have anything to replace it.” — Office Supply

“Sometimes the varieties of certain supplies are limited.” — Quill

“The site doesn’t always have what I’m looking for. Some items that I’ve purchased from Staples in the past are no longer available from there.” — Staples

Summary and Takeaways

An analysis of the user experience of four office supply websites found that

- Office Supply and Quill lead and Office Depot lags. Office Supply had the highest SUPR-Q rating (83rd percentile), while Quill had the highest NPS rating (23%). Office Depot had the poorest SUPR-Q score (50th percentile) and NPS (−6%).

- Key drivers of the overall website experience include the ease of finding products and having a clean, uncluttered interface. Each of these accounted for 12% of the variance in SUPR-Q ratings.

- Cluttered web pages, pop-ups being in the way, items being out of stock, and difficulties with navigation were pain points across websites. Due to these problems, providing better product organization, keeping inventory in stock, and displaying a cleaner interface should help improve the website experience.

For more details, see the downloadable report.