Of the many industries impacted by the pandemic, residential real estate is certainly among the top few, along with short-term rentals, online meal/grocery delivery, hotels, and airline travel.

Of the many industries impacted by the pandemic, residential real estate is certainly among the top few, along with short-term rentals, online meal/grocery delivery, hotels, and airline travel.

Real estate websites offer a nearly real-time inventory of available properties for sale and rent. The popularity of these sites surged as waves of people sought to relocate to larger homes outside major urban centers during the pandemic.

Many visitors to these real estate websites aren’t actively looking to buy or sell. With the average home price having increased at record rates in the U.S. and abroad, many are checking to see how much their property increased.

It turns out there are also a substantial number of website visitors just browsing other people’s homes for a sort of fantasy entertainment.

Regardless of the motivation for visiting, we wanted to understand what aspects of top real estate websites are driving customers’ attitudes and behaviors and which websites are excelling.

Similar to our earlier analysis in 2016, we collected data on a variety of attitudes and intentions toward several real estate websites:

We computed SUPR-Q® and Net Promoter scores, investigated reasons for using the websites, measured users’ attitudes regarding their experiences, conducted key driver analyses, collected think-aloud data, and analyzed reported usability problems.

Benchmark Study Details

Between March 2022 and April 2022, we asked 269 users of real estate websites in the U.S. to recall their experience using and perceptions of one of the listed online real estate providers on their desktop and mobile (app and or website) in the past year. An additional 49 users participated in remote MUIQ® think-aloud usability studies of the websites.

Quality of the Real Estate Website UX: SUPR-Q

The SUPR-Q is a standardized questionnaire widely used for measuring attitudes toward the quality of a website user experience. Its norms are computed from a rolling database of around 200 websites across dozens of industries.

SUPR-Q scores are percentile ranks that tell you how a website experience ranks relative to the other websites (50th percentile is average). The SUPR-Q provides an overall score as well as detailed scores for subdimensions of Usability, Trust, Appearance, and Loyalty.

The real estate websites in this study collectively averaged at the 68th percentile. Zillow and Realtor.com were roughly tied at the respective 83rd and 82nd percentiles, and Apartments.com scored the lowest at the 49th percentile.

Usability Scores and Trust

We asked participants to rate how easy they thought it was to use and navigate through the websites. Zillow had the highest usability score (89th percentile) and Apartments.com had the lowest (49th percentile). Comments about Apartments.com regarding usability included

- “I wish it was easier to filter my amenities search to narrow it down faster.”

- “Sometimes you have to use a lot of filters to refine your search.”

We also asked participants to rate the trust and credibility of the real estate websites. Trust scores were generally more modest relative to the usability scores. Zillow had the highest trust score (57th percentile). Apartments.com had the lowest trust score (28th percentile). Based on respondents’ feedback, this may be related to inaccurate information.

- “I do not like how I feel I cannot trust the info. It seems a lot of times when I visit the site, the apartments available are not always accurate or actually available and it bothers me.”

- “Some listings are just fake photos or photos about the company.”

Unlike the other websites, Redfin’s trust score improved from the 2016 study (the others fell), but it still had the lowest trust score of the websites in the 2022 study.

More verbatim comments are available in the downloadable report.

Loyalty/Net Promoter Scores

The average NPS for the real estate websites was 7% (slightly more promoters than detractors), ranging from −10% for Apartments.com to 28% for Realtor.com. In general, a better user experience is a good predictor of customer loyalty.

Use of Real Estate Websites and Mobile Apps

As a part of this benchmark, we asked participants how they accessed the online real estate services. All participants reported using their desktop/laptop computers (a requirement for participation in the survey), with 35% using mobile apps and 56% using mobile websites.

The typical frequency of use was a few times a month to a few times a year for desktop/mobile websites (on average, about 5% reported daily use). For those who reported mobile app use, the typical frequency of use was a few times a week to a few times a month. Realtor.com was the most frequently used mobile app (overall usage of 40%).

As expected, usage patterns were different for Apartments.com and the other sites, with 82% of the Apartment.com users looking for rentals and 0% looking to sell a property. Across the other four sites, the percentages (averaged across sites) looking to buy, rent, and sell properties were, respectively, 57%, 26%, and 7%—and for an optional Other response option, 11% reported browsing the sites and 8% reported checking the value of their property.

Key Drivers of the Real Estate Experience

To better understand what affects SUPR-Q scores and Likelihood-to-Recommend (LTR) ratings, we asked respondents to rate the following attributes of the real estate websites on a five-point scale from 1 (Strongly disagree) to 5 (Strongly agree). We conducted key driver analyses (regression modeling) to quantify the extent to which ratings on these items drive (account for) variation in overall SUPR-Q scores and, separately, LTR (the rating from which the NPS is derived).

- The website shows quality images of the homes

- It’s easy to contact a local agent

- There is information about nearby schools

- It’s easy to find the estimated mortgage

- There is good information about the neighborhood

- It’s easy to save a listing

- The property value on the website is accurate

- I can get a tax estimate for a property

- I’m able to share a home listing

- Maps of the property are available

- Street views of a property are available

- It’s easy to see new homes that just came on the market

- I’m notified when a price drops on a home I’m interested in

- There is information on how busy the street is for the home

- I can see how long a home has been listed on the market

- There is information about the last time a property was sold

- I can see how many people have viewed the listing

- There is information about how many bedrooms and bathrooms a property has

- I’m able to get updates/notifications for a property

- There is important construction information about homes on the website

- The properties are well represented on the website

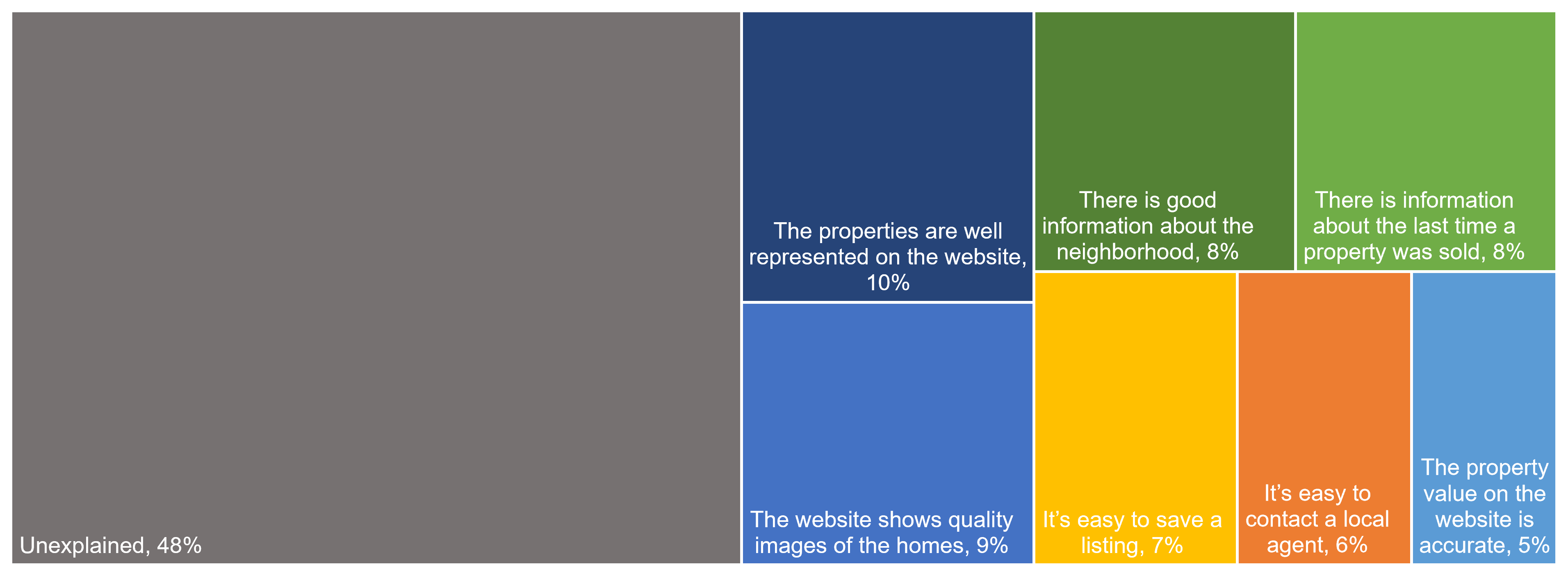

SUPR-Q Drivers. As shown in Figure 1, the top key drivers from the list above were “The properties are well represented on the website” and “The website shows quality images of the homes” (respectively accounting for 10% and 9% of SUPR-Q variation).

Other significant key drivers included “There is good information about the neighborhood” (8% of variation) and “There is information about the last time a property was sold” (8% of variation).

LTR Drivers. At a high level, the top key driver of likelihood-to-recommend (LTR, the basis of the NPS) was brand attitude (27%). At a lower level, using the same set of predictors as in the SUPR-Q KDA, the top key driver was “There is good information about the neighborhood” (14%).

What to Improve

Respondents experienced a few issues common across all the real estate websites, such as (1) inaccurate/untrustworthy information and (2) design issues.

Specific key areas of improvement cited by respondents for each website/app include

- Apartments.com: Appearance (e.g., “There is a lot of wasted space on the site, the elements are too big.”

- Realtor.com: Appearance (e.g., “The layout of home information seems buried below photos, and the browsing page is cluttered.”)

- Redfin: Inaccurate house values (e.g., “Their estimates are usually really off.”)

- Trulia: Difficult to filter/sort (e.g., “The filter features are sometimes hard to use.”)

- Zillow: Accuracy/trust (e.g., “I don’t know whether the information is reliable. So, I wonder how I can verify such information.”

Across all the websites, users experienced issues with filters and search.

- Apartments.com: “I dislike the map boundaries on the search feature.”

- Realtor.com: “I wish you could input a custom number for the home size, lot size, home age, etc. Instead, you have to pick from a preselected list of options.”

- Redfin: “I wish filtering was easier and more simplistic.”

- Trulia: “To search for disability accessible homes I have to use the keyword search.”

- Zillow: “I wish there were more specific qualifications to put in my search bar.”

Figure 2 shows a screenshot from Realtor.com illustrating a think-aloud participant’s attempt to find a home within a good school district (a problem experienced by five of the six participants who used Realtor.com in the unmoderated usability study.) There was an expectation that this would be in the “Community Amenities” filter, but it wasn’t.

Figure 3 is a short video (captured with MUIQ during the unmoderated think-aloud study) showing the difficulty a participant had with selecting the number of bedrooms with Redfin. Redfin requires users to select a range and helps them to do so, but this help was more confusing than helpful.

Figure 3: Difficulty selecting the number of bedrooms with Redfin (video).

Summary and Takeaways

An analysis of the user experience of five real estate websites found:

- SUPR-Q and NPS were mostly above average. Zillow had the highest SUPR-Q rating (83rd percentile). Realtor.com had the highest NPS (28%). Apartments.com had the poorest SUPR-Q (49th percentile) and NPS (−10%).

- Seven variables accounted for 52% of the variation in SUPR-Q ratings. The top key drivers were “The properties are well represented on the website” and “The website shows quality images of the homes” (respectively accounting for 10% and 9% of SUPR-Q variation). Other significant key drivers included “There is good information about the neighborhood” (8% of variation) and “There is information about the last time a property was sold” (8% of variation).

- Some UX issues were common across the websites. Respondents experienced a few common problems and frustrations across the real estate websites, such as inaccurate/untrustworthy information and design issues.

- Users experienced numerous filter- and sort-related usability problems. Participants struggled with filtering and sorting on all five websites.

- A key driver of variation in likelihood-to-recommend was “There is good information about the neighborhood.” This variable alone accounted for 14% of the variation in likelihood-to-recommend.

Full details are available in the downloadable report.